Note: Leaving all of your bitcoin and crypto holdings on exchanges exposes you to highly varying degrees of safety, security, privacy, and control over your funds and information as most exchanges are in custody of your private key. Perform your own due diligence and choose a wallet where you will keep your bitcoin before selecting an exchange. Also, ensure to safely keep your seed phrase for easy recovery of your wallets in case you lose access to your private key.

Which are the best Bitcoin Exchanges?

Join now

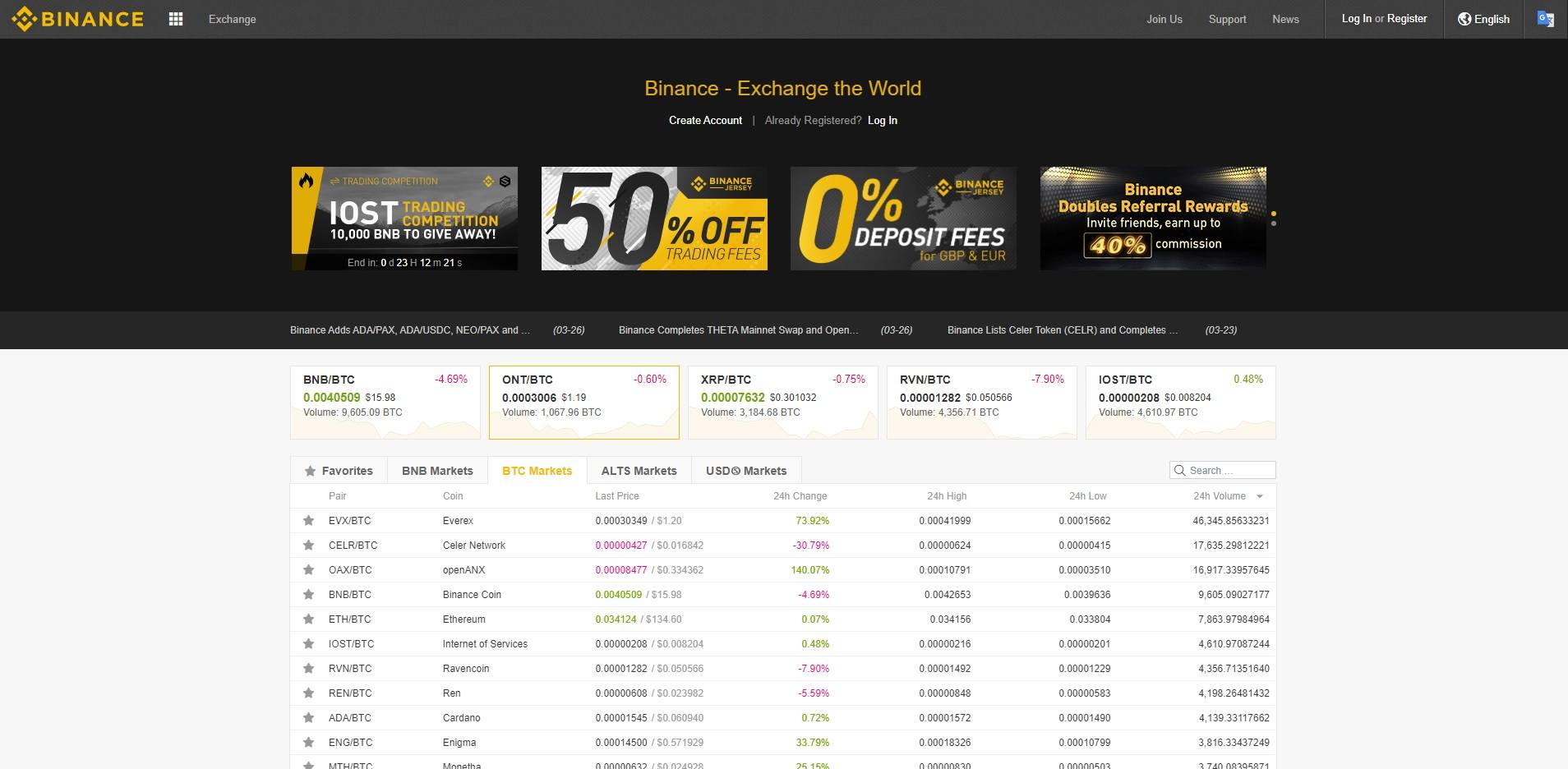

Binance

Binance is a cryptocurrency exchange and ICO launching platform that supports multiple languages.

The name was coined from two words, which are ‘binary’ and ‘finance’, where digital technology and finance meet.

Binance according to the CEO Changpeng Zhao is blockchain exchange 2.0, where he considers blockchain exchange 1.0 as those exchanges that convert traditional fiat currencies to either Bitcoin, Ethereum or Litecoin, … At the moment there is a whole slew of second generation coins which need a different kind of exchange.

The company boasts of their matching algorithm being capable of sustaining 1.4million order per second. This makes them one of the fastest exchanges today.

With experience in both finance and crypto space, Binance has been able to establish links with partners, who are capable of providing sufficient liquidity for the exchange.

Their customer service is relatively good, which minimal complaints from customers.

As an ICO launching platform, Binance had TRON as the first project t launched on the platform.

- Pros: Ease of opening an account, an ok customer service.

- Cons: Average user support.

Try it out

Changelly

This is a web based cryptocurrency exchange that unlike some other mentioned exchanges on our list, offers some degree of anonymity as transactions do not require e-mail confirmation.

Changelly was birthed as a startup prototype in 2013 by a Bitcoin mining pool called MinerGate.

Developments in 2014 were focused on the platform as an independent exchange service. Changelly was finally released to the public in April 12, 2015, after major updates.

Changelly has a primary objective of making cryptocurrency exchange extremely user friendly. This is done by the company acting as a link between a link and other crypto trading platforms, such as Bittrex, Poloniex etc.

Changelly is secured on an HTTPS security protocol, and all user accounts are mandated to have two-factor authentication.

The team took a step further to provide widgets for web publishers in the cryptocurrency community. This gives visitors to such third party platforms a one stop shop to carry out exchange of cryptocurrencies without having to leave the publishers page.

- Pros: Extremely easy to use platform and widgets, with good user experience.

- Cons: Varied transaction fees.

Check it out

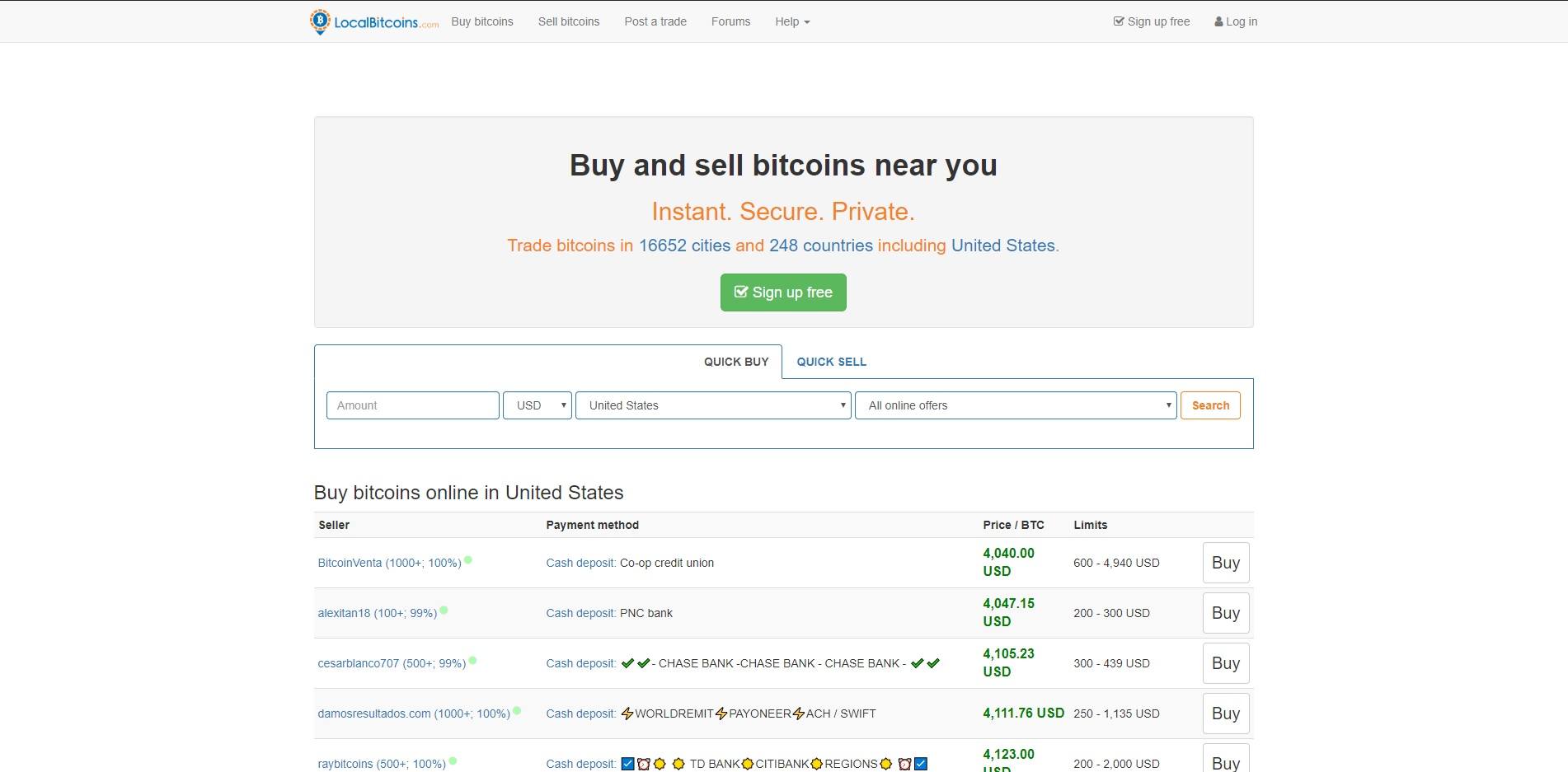

LocalBitcoins

LocalBitcoins is a popular go-to source for most newcomers in the crypto space.

Why is this so?

This is because it is a P2P Bitcoin exchange with buyers and sellers in thousands of cities around the world, allowing you to meet up with people in your local area; buy or sell bitcoins in cash.

Sending money through PayPal, Skrill or Dwolla are other popular payment methods.

You can even make arrangements with a buyer/seller for cash deposit at a bank branch.

Sellers who opt to set their exchange rates are charged a commission of 1% by LocalBitcoins.

For secure trading, the LocalBitcoins platform rate traders with a reputation ranking, along with publicly displaying previous transaction activities with other members of the community.

Localbitcoin holds sellers money in escrow once a trade is placed. Upon confirmation of trade completion by the seller, the funds are automatically released to the buyer.

A conflict resolution team is setup by Localbitcoins for cases where there are misunderstandings or glitches between buyers and sellers.

There is more information on LocalBitcoins FAQ

- Pros: It is great for anonymity since no ID is required. It is available globally, there is definitely a local bitcoin in your area, and it is beginner friendly. The service is usually free with instant transfers.

- Cons: It is quite difficult to buy huge volumes of bitcoins and the exchange rates are often high.

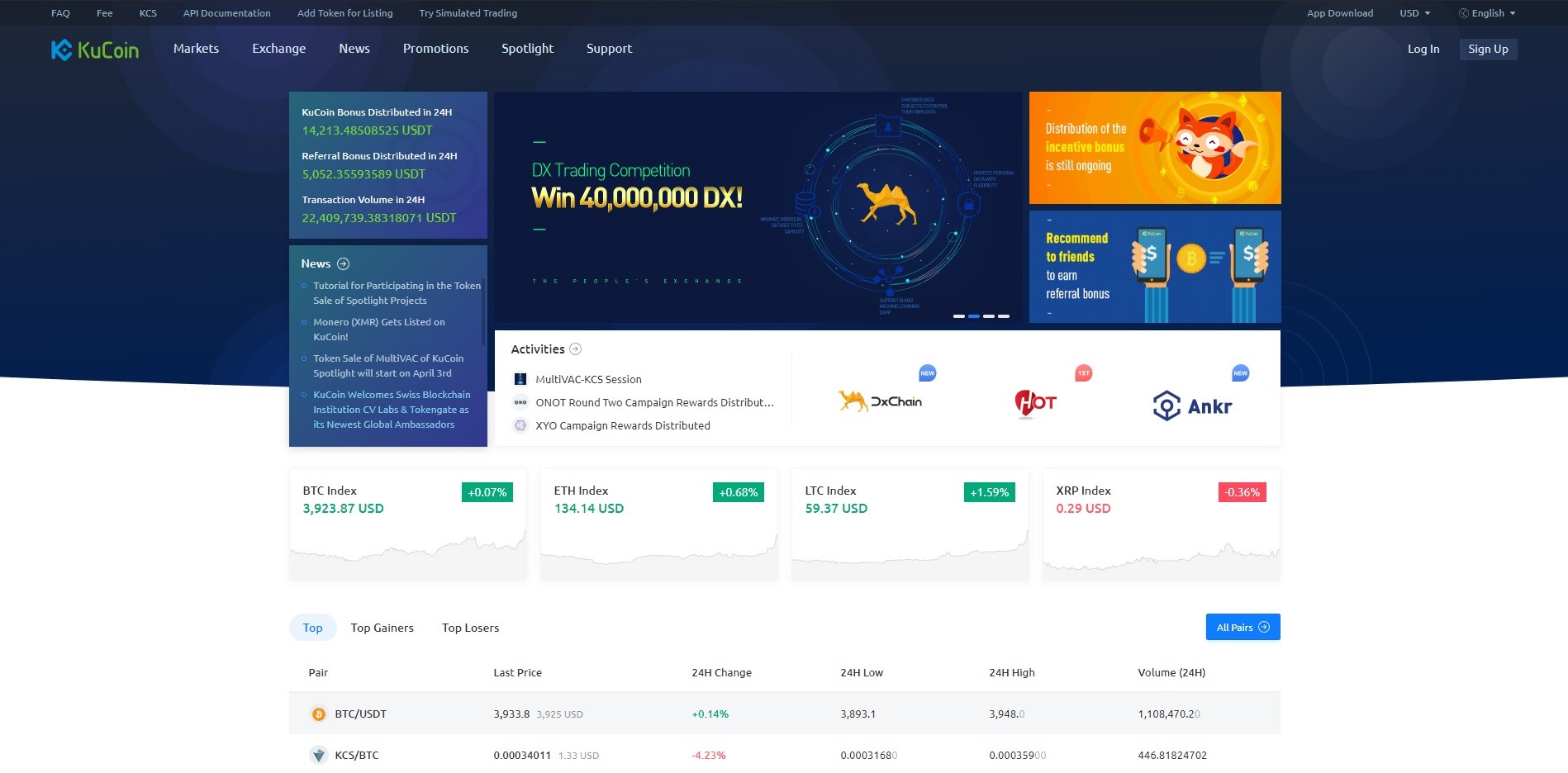

KuCoin

This is a China based blockchain asset exchange company, offering services in both English and Chinese language.

The company was founded by blockchain enthusiasts who have been relevant in companies like Ant Financial and GF Securities.

Kucoin primary goal is to provide their customers with ease of transacting with unique digital assets and cryptocurrency exchange services, with safety/security as a primary objective.

Their platform offers appealing user interphase and the user experience is great.

As a way of marketing and encouraging users to trade more, KuCoin offers a bonus plan that is based on invitation.

At the point of writing this article, they charge a trading fee of 0.1%.

More information on trading fees, withdrawal and deposit can be found here.

You can also find information related to their official White Paper, Announcements, API, and Bonus Calculator.

- Pros: An incentivized cryptocurrency exchange, allowing users to make passive income via referrals. Their platform offers most new ICO crypto that are not available on other exchanges.

- Cons: Still new in the exchange industry compared to older exchanges.

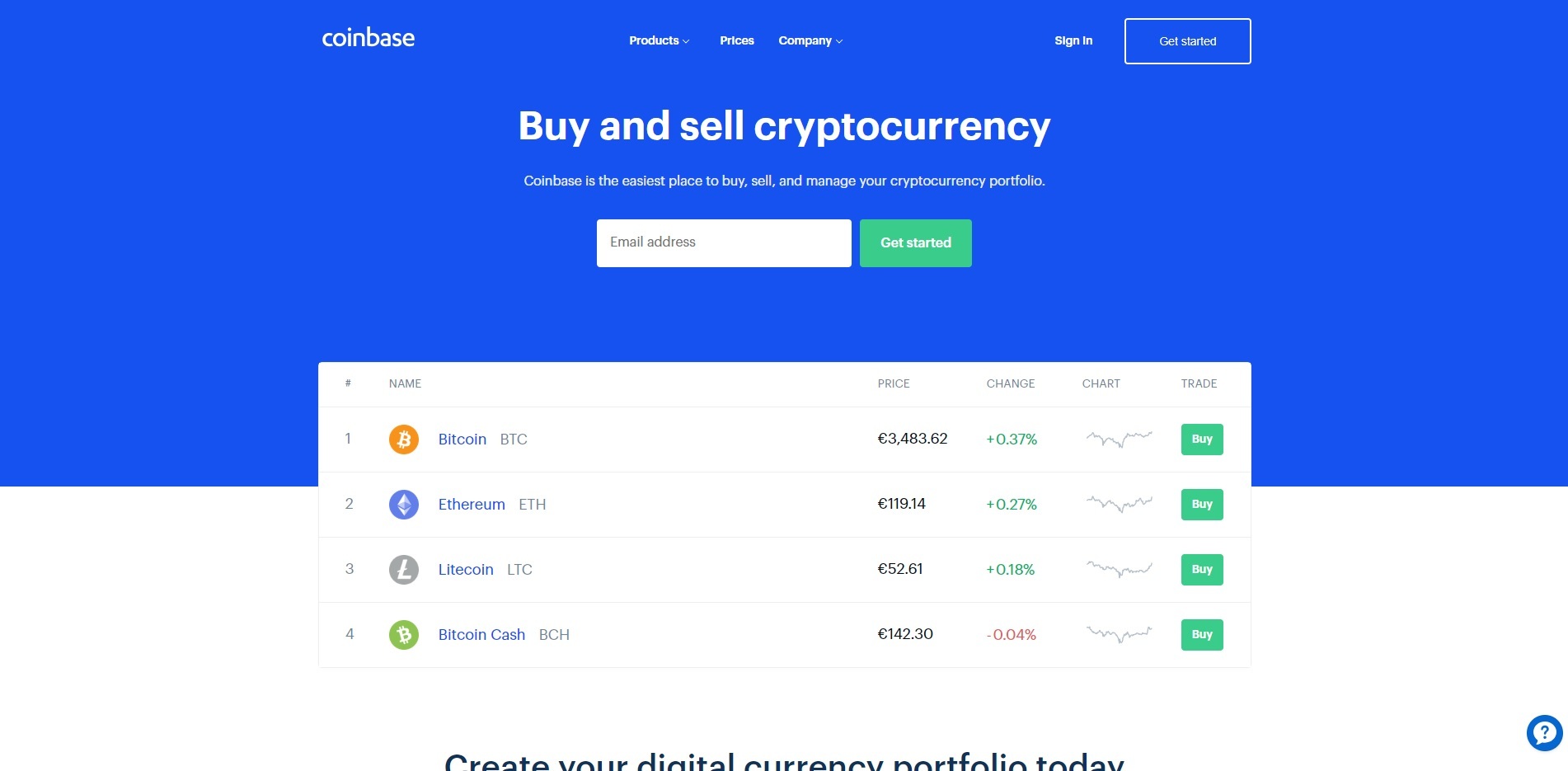

Coinbase

Coinbase has the backing of some trusted investors and used by millions of customers globally.

It ranks as one of the most popular exchanges in the world, offering a platform with great user experience.

On the Coinbase platform, users can securely buy, use and store digital currencies such as bitcoins and Ether through a digital wallet available on Android & iPhone.

Coinbase also has a Global Digital Asset Exchange (GDAX) subsidiary which also allows more experienced traders carry out trading operations. GDAX currently operates in the US, Europe, UK, Australia, Canada, and Singapore. GDAX does not currently charge any transfer fees for moving funds between your Coinbase account and GDAX account. For now, the selection of tradable currencies will, however, depend on the country you live in. For more information, visit the Coinbase FAQ and GDAX FAQ.

- Pros: They are very secure with a good reputation and reasonable fees. The platform is user-friendly, even for beginners, and stored currency is covered by Coinbase insurance.

- Cons: A not so good Customer support, limited payment methods and supported countries. Their approach towards a global service delivery is not uniform. Finally, their subsidiary GDAX is only suitable for technical traders.

Check it out

Bittrex

This is a cryptocurrency exchange based in the U.S.A with full regulation, designed with state of the art security and scalability.

The exchange boasts of lightning fast trade execution and stable wallets. Bittrex is user-friendly for both newbies and veteran traders alike.

Among the coins traded on Bittrex are Bitcoin, BitcoinCash, Cardano etc.

- Pros: Safe and secure transactions, fast trade execution, fully regulated.

- Cons: For traders who prefer to remain anonymous, Bittrex users must pass through KYC.

Check it out

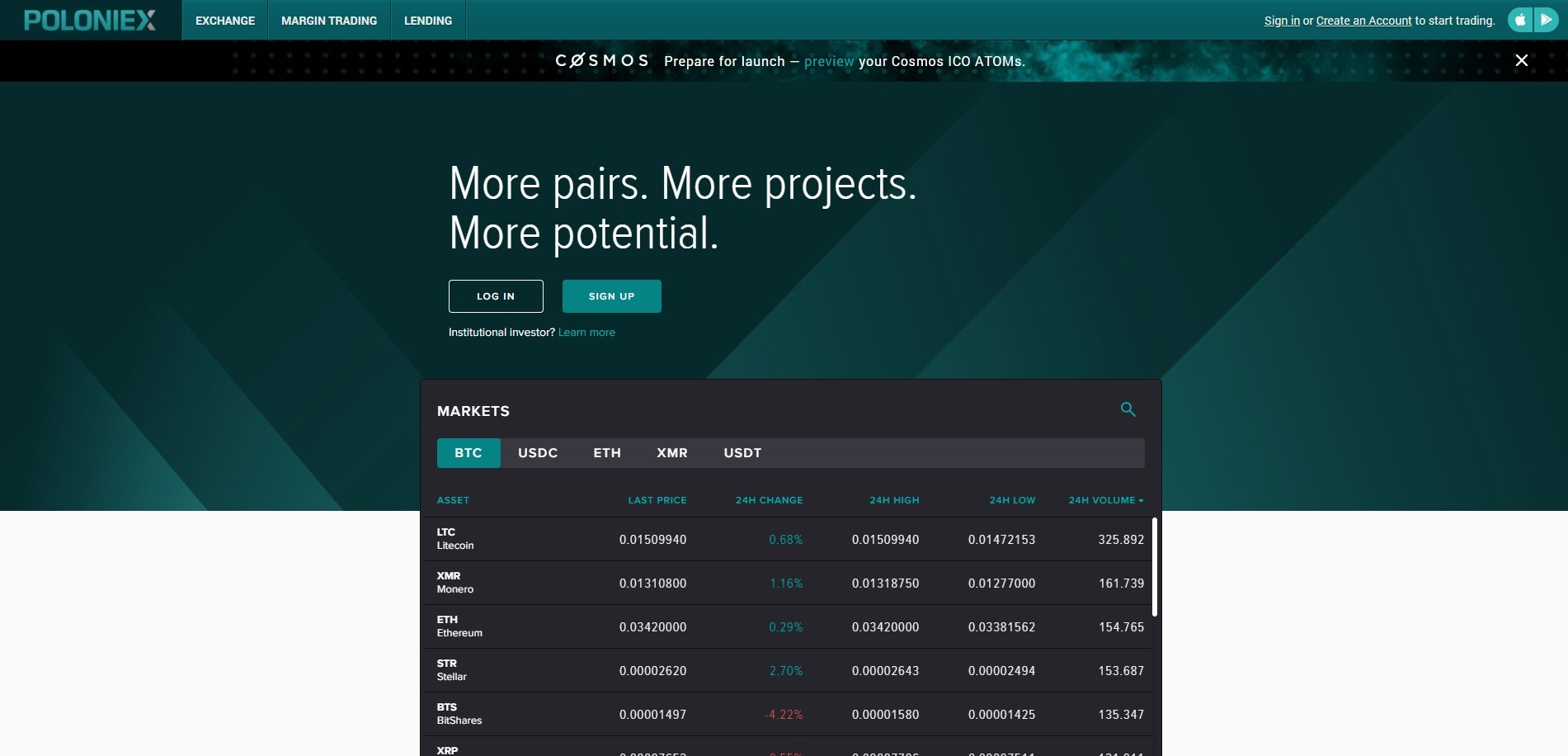

Poloniex

Poloniex was founded in 2014, and has grown to become one of the world’s leading cryptocurrency exchanges.

Visiting their website, you will notice a no-nonsense approach in their design, however, they concentrate more on the security of the platform.

They offer a variety of Bitcoin cryptocurrency pairs which are about a hundred, as well as data analysis tools for advanced users.

As one of the most popular trading platforms with the highest trading volumes, users will always be able to close a trade position.

Poloniex employs a volume-tiered, maker-taker fee schedule for all trades so fees are different depending on if you are the maker or the taker.

For makers, fees range from 0 to 0.15%, depending on the amount traded.

For takers, fees range from 0.10 to 0.25%.

There are no fees for withdrawals beyond the transaction fee required by the network. Poloniex recently closed their chatbox functionality sometime late 2017.

- Pros: Poloniex have a fast account creation process with very rich features. They also offer Bitcoin lending, margin trading, and high-volume trading. Their platform is user-friendly with low trading fees, open API, and they recently require KYC.

- Cons: Their customer service is really slow, and they have no support for traditional fiat currencies.

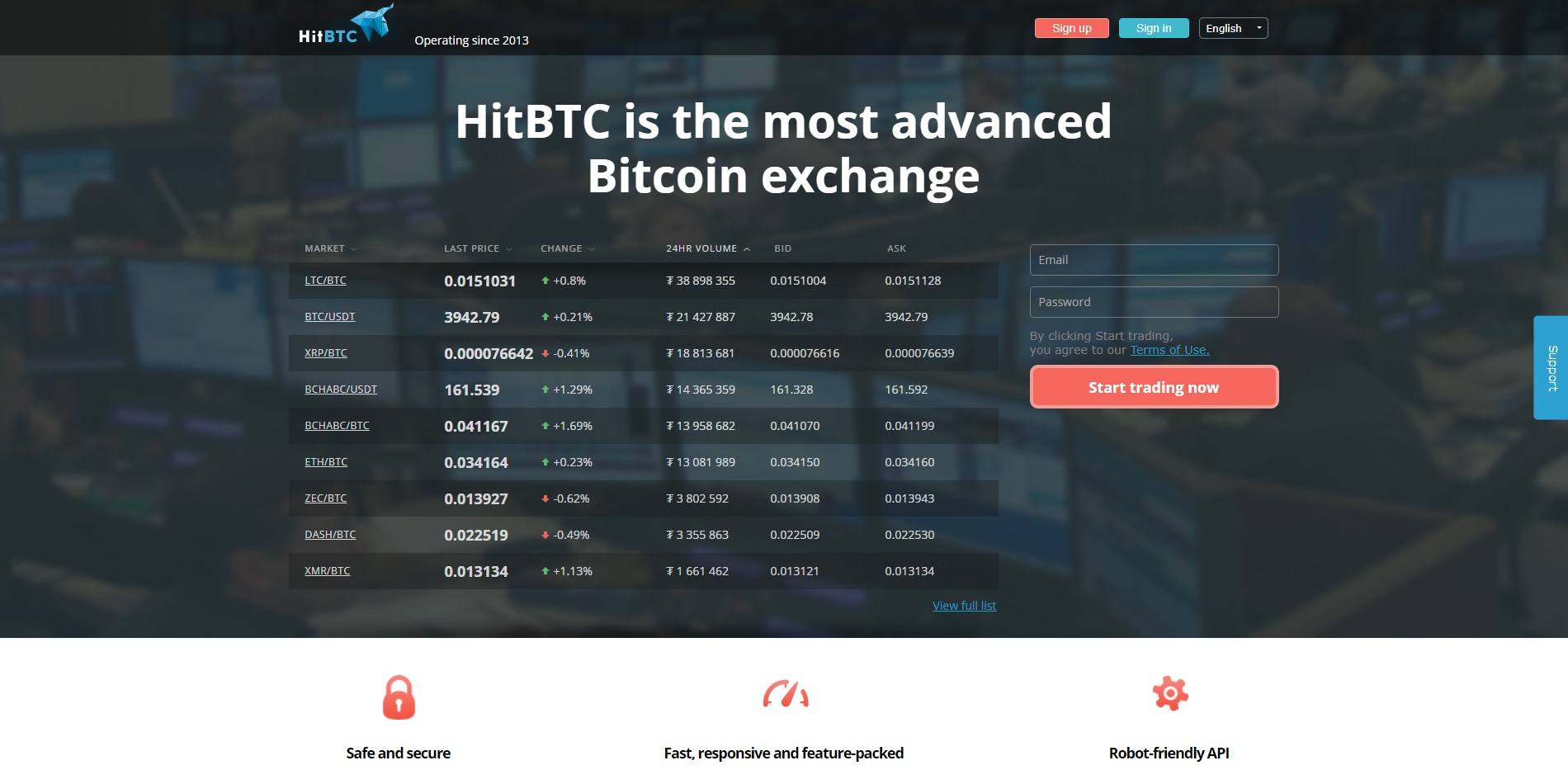

HitBTC

HitBTC started off as a cryptocurrency exchange based in Europe which is operated by Hit Techs Limited in London.

The company was founded in 2013, but further launched in 2014.

Not too long after its launch, HitBTC was hacked in 2015.

Hit Solution Ltd was registered under Hong-Kong jurisdiction with number 2510720 under the registered trade mark HitBTC again with the following domain name: https://www.hitbtc.com.

Following the hack of 2015, the company assured that customer funds were not affected, and promise to buffer up safety and security through two-factor authentication, use of cold storage, and advanced encryption.

HitBTC provides a level playing ground for beginners and expert algorithmic traders alike through the use of their robust API.

Users are allowed to trade cryptocurrencies which include but not limited to Bitcoin, Ethereum, Litecoin, Monero, Dash, and so many other alt coins.

For complete newbies to the world of trading or cryptos generally, HitBTC offers the possibility of demo trading, which is not too popular among exchanges.

- Pros: Offers demo trading for newbies and traders who want to try out their strategies/trading bots. HitBTC allows traders make deposits and withdrawals in traditional fiat currencies such as the U.S dollar and Euro. They offer low fees of 0.1% on every transaction.

- Cons: Their terminal is more suited for more experienced and professional traders.

ShapeShift

This is a leading exchange that supports a variety of cryptocurrencies ranging from Bitcoin, Ethereum, Monero, Zcash, Dash, Dogecoin and many other altcoins.

Do you want to make instant trades without account sign up?

Then Shapeshift is the right service for.

They do not allow users to purchase crypto’s with debit/credit cards or any other payment system.

The platform has a no fiat policy and only allows for the exchange between bitcoin and other supported cryptocurrencies.

For more info, please visit the Shapeshift FAQ

- Pros: Shapeshift has a very Good reputation in the Bitcoin and Altcoin community. Their website is user friendly, with dozens of Crypto’s available for exchange, and fast reasonable prices.

- Cons: Their mobile App can be considered average, and they offer no exchange of fiat currency. Also have limited payment options and tools.

Coinmama

Coinmama accepts credit card or cash via MoneyGram from anyone.

They are awesome for making instant purchases of digital currency using your local currency.

Not all functionalities on Coinmama are available to all countries, even though Coinmama has a global coverage.

The portal is available in English, French, Italian, German, and Russian. Visit the CoinMama FAQ

- Pros: The Coinmama platform has a great user interphase and user experience. Most importantly, they have a good reputation with a good range of payment options, available globally including fast transaction time.

- Cons: They have such high exchange rates, a premium fee for credit card, no bitcoin sell function, and average user support.

Bisq

Bisq is similar to Localbitcoin in that it is a peer to peer exchange that allows users access to buying and selling of bitcoins in exchange for fiat currencies or cryptocurrencies.

The service is being marketed as a truly decentralized and peer to peer exchange that is instantly accessible and requires no need for registration or reliance on a central authority.

Unlike Localbitcoin, Bisq never hold user funds and no one except trading partners exchange personal data.

The platform offers great security with multisig addresses, security deposits and purpose-built arbitrator system in case of trade disputes.

For persons seeking complete anonymity, Bisq is the perfect platform for you. You can start by visiting the Bisq FAQ.

- Pros: Their reputation is good, secure & private. Bisq has a vast amount of cryptocurrencies available, no sign-up, decent fees, open source, open to a more global market and great for advanced traders.

- Cons: Limited payment options, average customer support, not beginner friendly.

Bitstamp

Bitstamp was founded in 2011 as European Union based bitcoin marketplace.

They pride their platform as being one of the first generation bitcoin exchanges that has built up a loyal customer base.

Bitstamp is well known and trusted throughout the bitcoin community as a haven.

It offers advanced security features such as two-step authentication, multisig technology for its wallet and fully insured cold storage.

They have a 24 hrs. 7 days a week customer support and a multilingual user interface. Getting started is relatively easy, upon opening a free account and making a deposit, users can start trading immediately.

Visit the Bitstamp FAQ and their Fee Schedule.

- Pros: They have a high-level of security and good reputation. Bitstamps’ service has a wider global coverage and availability with low transaction fees, and equally great for large transactions.

- Cons: Their platform is not very beginner friendly, coupled with limited payment methods, and high deposit fees.

Cex.io

Cex.io offers a broad range of trading services in bitcoin and other cryptocurrencies .

This is one of the platforms that allow an easy trading of fiat money with cryptocurrencies and cryptocurrencies for fiat money.

For seasoned traders who will want to venture into professional trading of Bitcoin, they offer a user friendly dashboard for margin trading.

CEX also offers a brokerage service which provides novice traders an extremely simple way to buy bitcoin at prices that are more or less in line with the market rate.

The Cex.io website is secure and intuitive and cryptocurrencies can be stored in safe cold storage. Visit the Cex.io FAQ

- Pros: They have a good reputation, good mobile product, and support for credit cards. Their platform is also beginner friendly, with reasonable exchange rate, and a global support.

- Cons: Cex.io has an average customer support, and making deposits can be expensive.

Cobinhood

Cobinhood is a cryptocurrency exchange founded in 2017, with headquarters in Taiwan, Taipei City.

The company was founded by a successful entrepreneur Popo Chen, who also happens to be the CEO.

Marketed as next generation cryptocurrency, a very interesting point about this exchange is that they offer zero transaction fees and zero cut on margin funding interest earnings.

Services offered by Cobinhood includes cryptocurrency exchange/margin trading, as well as an ICO under writing service, guaranteeing 100% reserve for cryptocurrency deposits.

The platforms unusual name Cobinhood was inspired by Robinhood, which happens to be a commission free trading platform for Securities which includes Stocks and Bonds. Cobinhood’s primary aim is to be to cryptocurrencies what Robinhood app is to Equities.

The company Cobinhood has a mission to protect retail investors from fraudulent ICOs Initial Coin Offerings by carrying out due diligence on the coin/tokens that seek to be listed on their exchange.

- Pros: Free transaction, protection from fraudulent ICOs, sub-millisecond latency of trade execution allowing for effective (HFT) High frequency trading.

- Cons: One of the newest exchanges in the space. More suitable to experienced traders.

Bitcoin Exchanges Categorized based on Geographic Location

Bisq

Bitstamp

Bitwage

Kraken

Local Bitcoins

Europe

AnyCoin Direct

Bitcoin.de

BitPanda

BL3P

Paymium

The Rock Trading

Argentina

Australia

Bitcoin Australia

CoinJar

CoinLoft

CoinTree

HardBlock

Independent Reserve

Brazil

Foxbit

Mercado Bitcoin

Walltime

Cambodia

Canada

Bitaccess

Canadian Bitcoins

QuickBT

Chile

China

Costa Rica

Colombia

India

Indonesia

Israel

Italy

Japan

Malaysia

Mexico

Nepal

New Zealand

Nigeria

Peru

Poland

Singapore

South Africa

South Korea

Ukraine

United Arab Emirates

United Kingdom

Bittylicious

CoinCorner

Coinfloor

United States

Venezuela

Visit the review section for detailed reviews on some of the above cryptocurrency bitcoin exchanges.

Visit Coin ATM Radar to find local Bitcoin ATMs.

What are Cryptocurrency Exchanges?

Cryptocurrency exchanges are web-based portals similar to market maker brokers, where buyers and sellers can exchange one cryptocurrency for another, or for traditional fiat currencies such as the U.S Dollar, Euro, or the Pound. If you are the serious type of investor that wants to trade these new assets professionally, it will be advised that you subscribe with an exchange that carries out KYC (Know your customer).

Reason being that, the cryptocurrency space at the moment can be a wild-wild-west, with faceless companies springing up without proper regulations. However, if you are only interested in making a quick conversion from one currency to another, there are trading platforms that offer such service. We can break down these exchanges into 3, which include:

Exchanges/Brokerage:

These are companies that offer a web-based or stand-alone platform, similar to Forex trading market maker brokers. They set the ask and bid price of the cryptocurrency, as well as charge spreads, in some other case, commissions.

Direct Trading Exchanges:

They provide a platform that allows participants from all over the world to exchange/ trade currencies directly between themselves. On these platforms, Bitcoin or any Altcoin price is not determined by the Exchange, it is purely demand and supply.

Trading Platforms:

These are web portals that connect buyers and sellers and take a fee from each transaction.

How do Cryptocurrency Exchanges work?

Do your Due diligence before you sign up with an exchange!

Below are important considerations when you go shopping for a broker. Consider these a market checklist.

Reputation:

Before you make that first cryptocurrency trade, it is necessary you do a little research on the trust level of the exchanges. Good sources where you’ll get an unbiased opinion on any exchange include the Bitcoin sub Reddits and BitcoinTalk.

Security of website/Servers:

As we are currently living in a world where a vast majority of people have no idea how Wi-Fi works, and with sophisticated technologies coming out every day/week, it may surprise you that some companies have no measure for securing these new assets. An example is Mt.Gox where depositor/traders coins were stolen. Again do a little bit of research into how Bitcoin is safely stored, and inquire on how these companies are doing this. This is because most exchanges hold traders private keys, and in the even, they get hacked, you stand the risk of losing your entire investment, as Bitcoin transactions are irreversible.

Geographical Restriction:

It is common that certain exchanges are fully open to only users of a particular geographic location. Find out from the brokers, or through Reddit, and BitcoinTalk on location-based restrictions. Check out a comprehensive list of exchanges at the end of this article that we consider for different countries of the world based on popularity and usability.

Know Your Customer (KYC):

Most exchanges based in Europe and the United States require some form of identification before you can be allowed to carry out Bitcoin transactions. This is in compliance with government regulations against money laundering and terrorist funding. If you are the type that prefer being anonymous, there are exchanges who offer limited services for a particular level of verification. You have a limited withdrawal limit for remaining anonymous.

Structure of Transaction fees:

Find out if the transaction fees offered by the exchange are fixed, varied percentage, or a spread in the case of a market maker. It will be in your benefit to know this, as their fees may or may not favor you r investment strategy.

Methods of Payment:

This, to many, may be the reason for getting in to Bitcoin trading in the first place. Find out about the withdrawal and deposit methods for the exchange, and how long it may take for these transactions to be confirmed. Having a broker offering multiple deposit and withdrawal methods is the way to go. However, you should note that credit card payments often attract high transaction fees as they are susceptible to fraud. Transactions via Bank wire usually take longer, as it takes time for banks to process the transactions.

Transparency of data:

Market maker brokers often allow you a demo account to try out their platform data. Please note that this data may be slightly different from the live data. This shouldn’t be a problem if your strategy is a buy and hold strategy, but for short term trading, it might be.

It is also important to check the reliability of their volume and order book.

Exchange/Broker Closing Time:

Cryptocurrencies are different from Fx trading currencies in the area of closing time. Most Forex brokers close on Fridays, to open Monday morning. Cryptocurrencies are open and traded Sunday to Sunday, so ensure to subscribe with an exchange/broker that offer such service. Those that don’t often have their customers see currencies experiencing huge gaps.

Variety of Fiat and Cryptocurrency pairs:

A broker/exchange with a wider market range provides you with options to diversify your risk. Since the cryptocurrency market is still young, brokers that offer new ICO tokens for trading may only be available in not too popular exchanges. Bear in mind that these may be risky, although have huge prospects of higher returns.