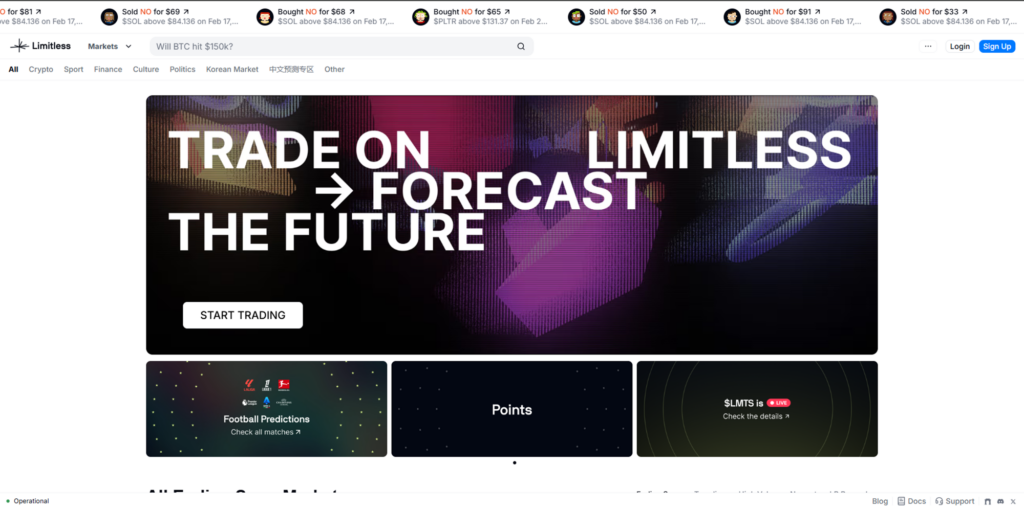

Limitless Exchange is an on-chain prediction market built on Base. The platform allows users to easily trade outcome shares on crypto and real-world events. Limitless Exchange utilizes a clear, order-book style interface as opposed to cumbersome AMMs. This allows for fast, intuitive trading and far greater transparency.

In late 2025, Limitless Exchange raised US$10 million in a seed round, from major names like 1confirmation, Coinbase Ventures, DCG, and several others. This is a signal of confidence in its model and long-term potential. Around that same time, platform’s cumulative trading volume topped US$500 million; thus, achieving the title of the largest prediction market on Base.

The platform is becoming equally popular among casual predictors and seasoned speculators with instant-settlement trades, low fees, easy wallet-based onboarding and the upcoming launch of LMTS token. It’s real-time crypto prediction, natural language markets and speed of execution make it one an accessible prediction-market platform.

This Limitless Exchange review includes everything from how Limitless Exchange works, what makes its markets different, how the LMTS token and airdrop works within the ecosystem, key features, funding milestones, and a step-by-step on how to participate safely and claim your Limitless (LMTS) airdrop.

Basic Information:

| Category | Detail | Category | Detail |

| Platform Name | Limitless Exchange | Industry / Sector | Crypto, DeFi, Prediction Markets |

| Platform Type | Decentralized prediction-market & on-chain trading platform | Network | Base (EVM Layer-2) |

| Trading Model | Central Limit Order Book (CLOB) | Founded | 2021 |

| Markets Offered | Crypto, stocks, yes/no events, short-term prediction markets | KYC Requirement | No KYC — fully on-chain |

| Token Name | LMTS | Token Supply | 1,000,000,000 LMTS |

| Token Launch (TGE) | October 22, 2025 | Token Utilities | Staking, rewards, governance, fee discounts |

| Whitelist / Airdrop | Yes — ecosystem rewards & LMTS airdrop (24.37% allocation) | Bounty | YES |

| Funding Raised | $10M seed round (2025) | Key Investors | 1confirmation, Coinbase Ventures, DCG, F-Prime, Node Capital |

| Trading Volume Milestone | Surpassed $500M+ cumulative volume by 2025 | Cross-Chain Expansion | Base → BNB Chain (announced) |

| Regulatory Status | Unregulated (standard for decentralized prediction markets) | Audit Status | No publicly available audit |

| User Stats | Exact user count not disclosed; volume milestone available | Token Unlock Information | Only allocation %s publicly available |

Limitless Exchange Overview — Key Facts & Features

Limitless Exchange is a cryptocurrency prediction market platform developed on the Base blockchain that enables users to predict and trade cryptocurrency prices via short-term markets. Limitless Exchange is powered by Base and offers fast, low-cost trades through which anyone can engage with on-chain prediction markets without any liquidation risk. People purchase “Yes” or “No” shares in the outcome of a market event, which then settles according to the resolution of that event. The platform has a CLOB interface for entry of market and limit orders and provides an intuitive trading experience.

Limitless Exchange has seen rapid development with total trading volume exceeding $500 million since the launch. It is the largest Base blockchain prediction market platform as of 2025. Major investors include 1confirmation, Coinbase Ventures, Digital Currency Group, F-Prime, Collider, Node Capital and Arrington Capital. The platform announced on October 20th, 2025, that it raised a seed round of $10 million, which will allow it to expand and launch the LMTS token. Limitless also aims to expand its user base and improve scalability with BNB Chain cross-chain integration.

The Limitless Exchange’s native token, LMTS, was launched on October 22, 2025. It is for staking, governance, rewards and for engaging with communities. About 24.37% of the total token supply is set aside for ecosystem incentives and early users to encourage engagement.

Limitless Exchange offers ease of use and flexibility. Although the interface is very novice-friendly, advanced trade features are coming according to the roadmap laid out by the team. Limitless Exchange has fast trade execution, growing user adoption, and expansion to multiple chains underway. The combination of features makes Limitless Exchange a likely candidate to become a leading crypto trading platform and prediction market. In addition, it offers a way to engage in the growing world of on-chain trading.

Core Features:

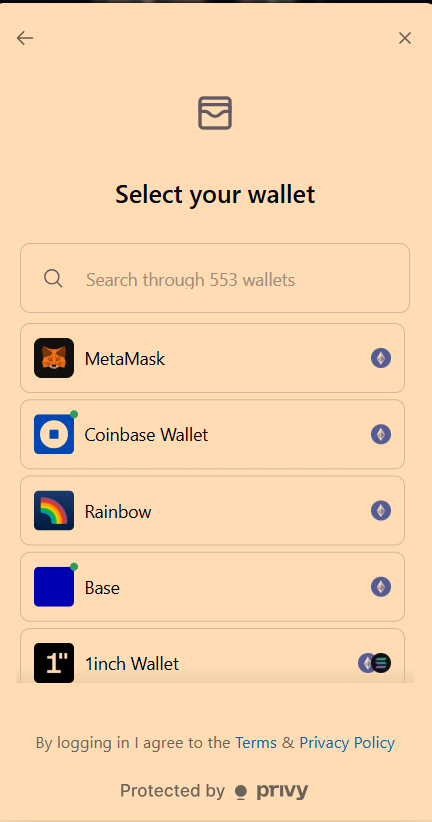

- “Access via wallet without KYC”: Users can connect a Base compatible wallet directly to trade, making the platform easy-for-beginners to enter.

- Central Limit Order Book: The trades use an order-book system. This is not AMM based. And it supports market and limit orders for better pricing discovery.

- Binary “Yes/No” Contracts: Users buy and sell outcomes just in the form of ‘YES’ or ‘NO’. Outcome shares will settle when markets resolve.

- LMTS Token Utilities: The LMTS token allows users to stake their tokens, participate in governance decisions, earn rewards, and other ecosystem incentives.

- Funding and Backing: Backed by prominent investors like 1confirmation, Coinbase Ventures, DCG, F-Prime, Collider, Node Capital, and Arrington Capital.

- Cross-Chain Expansion (Planned): BNB Chain Integration Announced for Enhanced Scalability and Liquidity.

- Fast, Low-Cost Trading (Advertised): Limitless claims trades are settled quickly, with low fees and no risk of liquidation.

- User-Friendly Interface: Created for simplicity, prediction markets can use advanced features only gradually.

How Limitless Exchange Works — Account Setup & Trading Flow

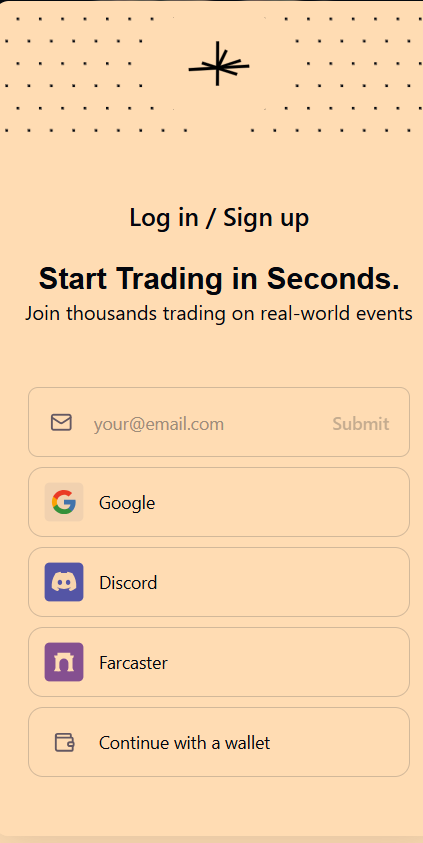

Limitless Exchange is quite easy to use if you know Web3 protocols. To start with, you connect a Base compatible wallet (Metamask or one like it). No regular sign up or KYC is needed. Once you link your wallet to Base, you can then deposit a stablecoin (e.g. USDC) or any other token supported on Base to view live prediction markets.

When you choose a market for instance, a future crypto price or some other event outcome, you trade by buying either “Yes” or “No” shares. Unlike AMM, Limitless employs a Central Limit Order Book (CLOB) model. This means you can have market orders for instant execution and limit orders to set your target price. The design has the appeal of a traditional exchange style trading but is fully on-chain and decentralized.

Once you enter a position, the outcome will resolve when the market closes. If you are correct, the yes or no share pays off. If not, it expires worthless. With this setup, users are able to make guesses on events in a transparent and blockchain settled manner. This means that complex derivative contracts and off-chain intermediaries aren’t needed.

As a decentralized wallet, Limitless allows users to do KYC-free crypto trading and maintains control over their money. The whole flow (wallet connect → fund wallet → choose market → place market or limit order → wait for resolution ) keeps things simple, especially for newbies.

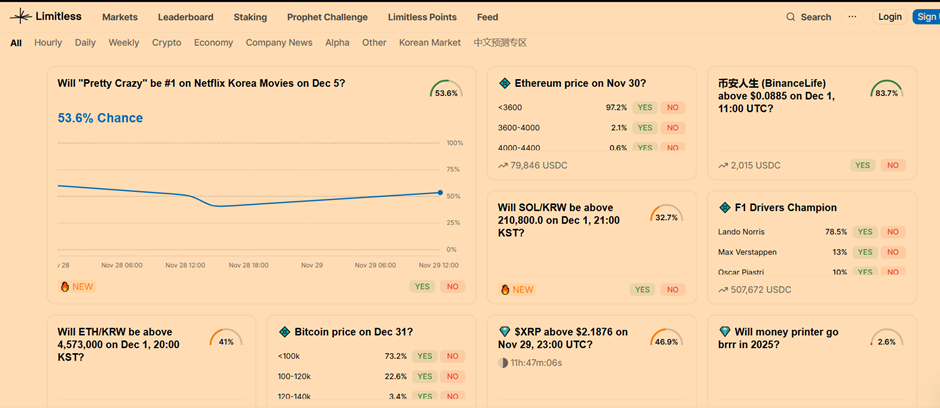

Markets & Trading Options on Limitless Exchange

Markets on Limitless Exchange help people make money off short-term crypto and asset price predictions. The platform allows users to engage in “yes/no” outcome contracts. They allow you to buy shares predicting whether a particular event will or won’t happen. In other words, it means you don’t have to actually own the underlying token to speculate; you are only trading predictions.

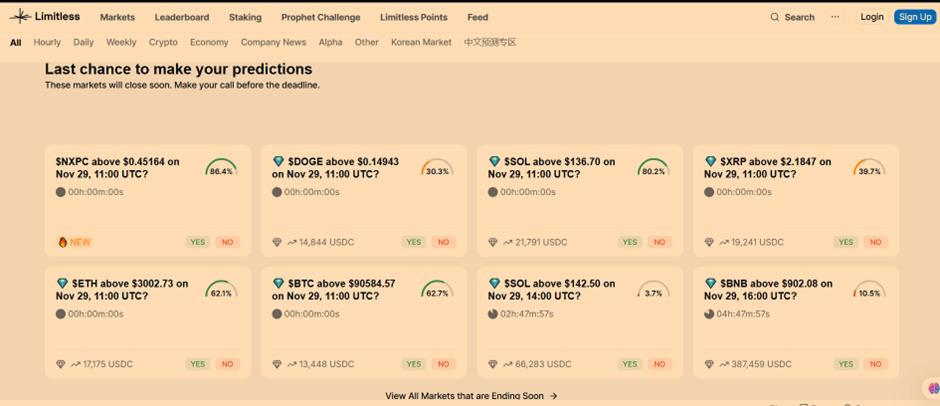

Available Markets

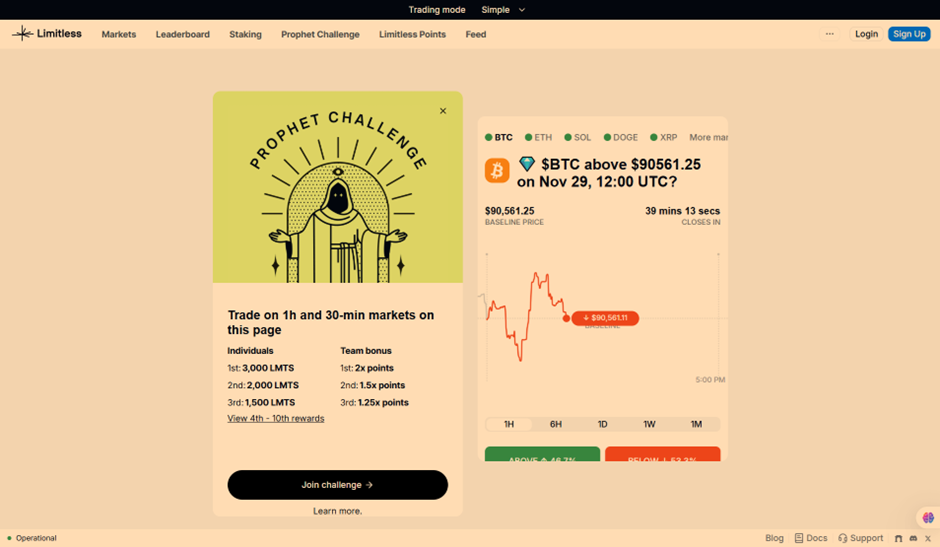

As per project documents and press coverage, Limitless enables short term markets such as 30 minute, 60 minute and other fast settlement windows that give traders access to frequent “real time crypto predictions” instead of longer-term bets. The platform also offers prediction markets on popular crypto coins such as BTC/ETH and possibly a wider array of tokens.

The Limitless Exchange architecture uses a Central Limit Order Book (CLOB) rather than an AMM: allowing you to place market orders for execution or limit orders to choose your entry price a more exchange style trading model than many classic prediction markets.

Trading flow & liquidity / custom market potential.

Limitless can, in theory, support markets of your own design. What this means is, the platform can create many outcome-based contracts. Some sources mention “100+ markets in Advanced Pro Mode”, which suggests a variety of events or price targets that users can trade. Stabledash+1.

As per the seed round announcement of October 2025, Liquidity and user participation have increased rapidly, the platform reportedly already handled over $500 million in cumulative trading volume, which may imply there’s enough activity to support many market types and reasonably deep order books.

Limitless Exchange Fees, Liquidity & Earning Opportunities.

When trading on Limitless Exchange, with opportunities available around fees, liquidity provision and rewards, it pays to know what’s verified and what’s still uncertain.

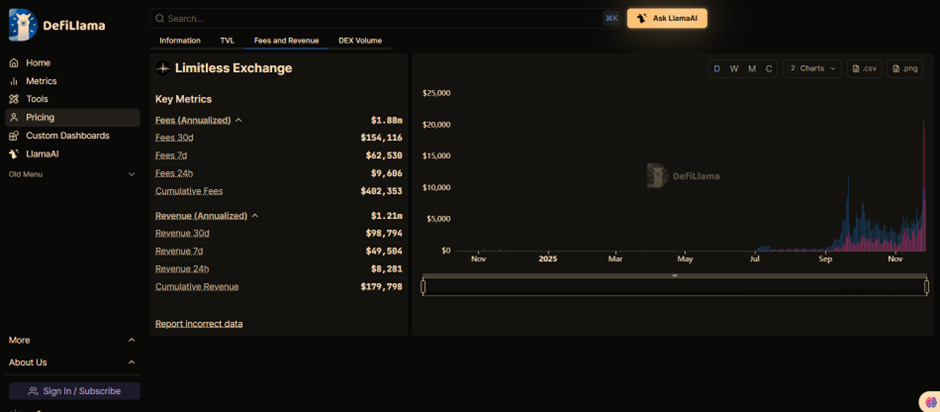

Fees & Revenue Stats

Available data suggests that Limitless has obvious fee revenue. One analytics site DeFi Llama estimates recent fee revenue at $9689 per day, with more recent metrics showing fee increases at $154,116 over 30 days and cumulative revenue history sideways. This indicates that Limitless Exchange does charge trading fees and is building up volume, possibly for liquidity and sustainability.

Liquidity & Order Book Model

Limitless employs a Central Limit Order Book (CLOB) instead of having an Automated Market Maker. In other words, this suggests that orders are executed via an order book system. Further, it usually favours deeper liquidity and clear price discovery against typical pool-based markets.

This architecture assists when there are numerous active users through better fills, more efficient trading, and possible tighter spreads, which is a strong positive for serious traders.

Earning Opportunities & Rewards (for Liquidity Providers / Active Users)

The platform now officially includes LP (liquidity provider) rewards and incentives. Holders/traders can provide liquidity, stake our token (LMTS), or join rewards programs to earn added value. Users can earn through trading and depositing. But according to the documentation, rewards come from a mix of fee sharing, staking yields, and ecosystem incentive.

In addition, Limitless has proposed special compensation mechanisms for liquidity providers, such as earning a yield from “spot exchange trading fees” plus “premiums / profit share / loan interest / origination fees” when their liquidity is used for lending or leveraged trades.

Limitless Tokenomics (LMTS) & Staking Review

The LMTS token forms the backbone of Limitless Exchange’s ecosystem. You can think of LMTS as an all-access pass. Stake, earn rewards, reduce trading fees and govern with it. LMTS is built on the Base blockchain as an ERC 20 token, with a total supply capped at 1 billion tokens. So, there’s a clear limit, which is always good for token value.

Token Distribution

The LMTS tokens are shared across various entities like the investors, team, liquidity pools, etc. About 24% is reserved for ecosystem rewards and airdrops, giving early users and traders an edge. The tokens for investors and the team are locked and slowly released over time to prevent dumping and balance the system. Not ony does It rewards you for being active on the platform, it also helps in growing the ecosystem.

The token is not for just holding it has its use. By staking LMTS, you can earn rewards, receive trading fee discounts, and get priority access to new markets and features. Moreover, a portion of the platform fees is allocated to a buyback mechanism that can enhance the value of the token over time. The early players also get airdrops and other incentive programs that let you earn more from the platform apart from trading. Just like any other crypto token, its rewards and value depend on the activity on the platform. It is important to be aware of the trading volume and liquidity because the rewards for staking fees, discounts, and buying power vary.

Overall, LMTS will help to achieve a more interactive, rewarding and community-centric Limitless Exchange. With LMTS, you can participate and benefit as the platform grows, whether you trade casually or provide liquidity.

User Interface & Mobile Experience on Limitless Exchange

When you visit Limitless Exchange, one of the first things you will notice is how clean and straightforward the platform is. The home page is fast and easy to navigate as you can jump into markets, view your portfolio, or connect your wallet with just a few clicks. The website has an exchange style layout that anyone familiar with a centralized or decentralized exchange will understand.

Because Limitless runs entirely in a web browser, you don’t need to download a special app to trade. It makes it convenient to access it from any phone, tablet or laptop – which is a bonus for mobile traders or people who check on the go. Users can keep track of their bets and positions on any screen size on a ‘desktop’ as well as ‘markets’ sections of the interface.

Limitless offers a simple UI for placing trades or checking outcomes. The “Yes/No” markets show clearly, order books are easy to read and order types (market or limit) are laid out in a way that feels familiar, like a normal trading exchange, but for predictions. The user experience is well-designed and smooth so that it doesn’t overwhelm new users, yet still feels powerful for experienced traders.

That said, the platform also features advanced tools that are meant for liquidity providers. In Advanced Mode, users can place limit orders or add liquidity. These options are clearly visible and easy to access. So, Limitless is much more than a prediction site; it also supports active strategy-driven trading.

Is Limitless Exchange Safe?

When facing the question “Is Limitless Exchange legit”, there are a few strong points, and also some gaps to note.

On the upside, the project behind Limitless went public and launched the native LMTS token after the seed round fundraising. The endorsement of known investors hints at some scrutiny at the outset. Regarding Limitless’ smart contract security audits and transparency, the platform’s smart contracts underwent security audits by firms Trail of Bits and Quantstamp in mid-2024, with no critical vulnerabilities reported. However, the audit report isnt available publicly. It generally appears on well-known audit scanner sites either with no audit or “audit not applicable,” which means there is missing or ambiguous independent third-party assessment documentation.

Since there is no public audit data available, it is tough to evaluate the potential risk of contract vulnerabilities as well as upgrade procedures or hidden bugs. Thus, statements that Limitless is “completely safe” should be taken with a pinch of salt, as they rely on trust in the team and not on proof.

Overall, while the project does publish general tokenomics, funding and some basic metrics (e.g. total supply, token allocation, funding history). So that helps; but there is little public evidence of ongoing security audits, code audits, or independent audit of each contract. If you care about long-term security and want to ensure your funds remain protected, this is a bad sign.

Promotions, Airdrops & Competitions on Limitless Exchange

Limitless Exchange is different for a variety of reasons. But, one of the more notable ones is the number of promotions, airdrops and user reward programs rolled out. These programmes aim to build and reward participation from the community. As part of the launch of LMTS, Limitless allocated about 24.37% of the total supply for airdrops and other ecosystem rewards. Thus, it implies that a good number of lucky airdrop and early adopters will be able to bag free tokens.

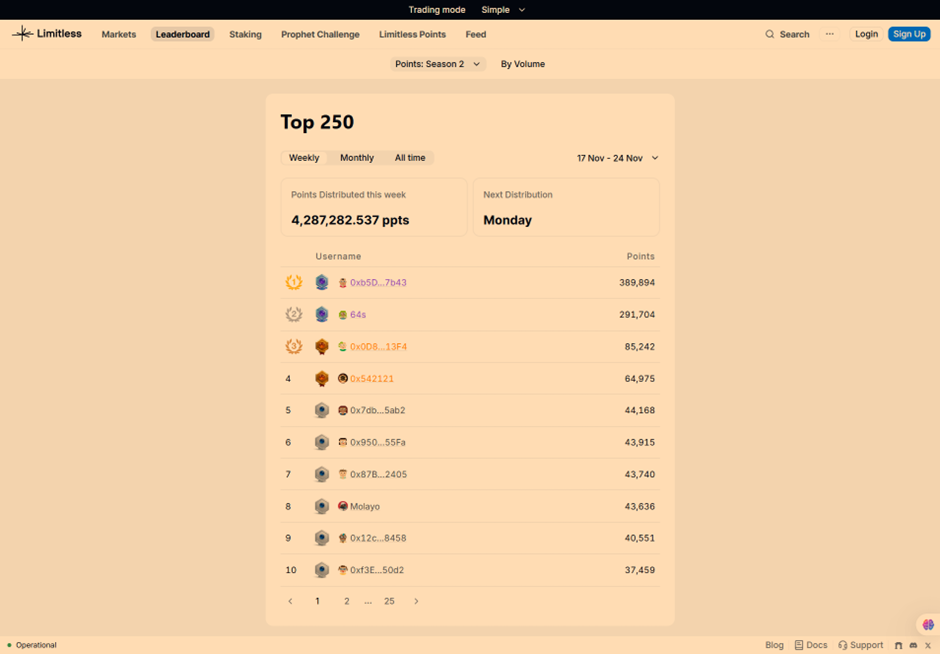

Prior to the token generation event (TGE), Limitless had a “Points Program” that allowed users to collect points by trading, liquidity provisioning, and engaging with the platform. The eligibility and allocation size for the airdrop were determined by these points. The onboarding incentive shows how Limitless tries to reward early adopters or active users in an inclusive way.

After the launch of LMTS in October 2025, Limitless opened airdrop claim applications for eligible wallets. Now, users can claim tokens if they took part in previous seasons of the Points Program or other qualifying events.

Apart from airdrops, Limitless experimented with leaderboards and contest type rewards. The internal challenge (which sometimes goes by the name ‘Prophet/Points challenge’) rewards the best traders or liquidity providers based on performance or trading volume. This adds a fun competitive element where users are competing for added rewards.

Payments, Deposits & Withdrawals

Limitless Exchange largely moves money via crypto, as it’s built on the Base network. For transactions, one connects a cryptocurrency wallet, funds it (often with a stablecoin such as USDC), and then uses those funds to trade, or take positions.

Since Limitless operates on Base, your transactions deposits to your wallet, trades, and withdrawals are on-chain. This often means that the only fees you’ll incur for deposits and withdrawals will be the regular Base network gas fees and these won’t come with an extra layer of custodial fees or identification delays.

Similarly, If you want to withdraw your money after exiting a trade or closing a position, you would withdraw from your connected wallet. Since the system uses your wallet in a decentralized manner, withdrawal is basically a transaction on the blockchain itself.

However, since everything remains on chain, you control your wallet and so, if you lose private keys or send to the wrong address, you could lose funds. Additionally, Limitless does not feature a public “fiat on ramp/down ramp”. In essence, you will need another exchange or bridge to convert those tokens into cash.

Customer Support & Community

Limitless Exchange seems to be creating support and community for its users. The project keeps in touch with its community via social/chat platforms. According to Limitless airdrop guide listing, their official channels include their main website, Twitter/X handle, and discord – a mainstream Web3 style community setup. It can be useful if you want to follow announcements, engage in promotions/airdrops or ask questions informally with other users.

Because Limitless is decentralized and wallet based, it does not have a “customer service hotline.” Rather, community channels (Discord, social media) and help docs seems to be the best ways to get support. This indicates that the response time and support quality may not be the same, which is normal with most crypto native platforms.

To sum up, Limitless Exchange comes with an essential but useful support system including official help documents and community channels. This means that there are ways for users to get help or follow community updates, but that support likely leans on community engagement rather than outlined customer support infrastructure.

Limitless Exchange Pros & Cons

Limitless Exchange Pros

- The Base Blockchain allows for fast on-chain settlement, and low fees which makes for seamless trading which is a positive for Web3 native trading.

- The platform has a known order book (CLOB) model (not a pool/AMM), which usually offers clearer price discovery and possibly better liquidity for Prediction Market contracts.

- The local token called LMTS is designed in a way that allows staking, fee discounts, ecosystem incentives, etc. This greatly rewards active players beyond predictions.

- A recent US$10 million seed round, which drew strong backing from serious investors, adds credibility to this project’s development and long-term vision.

- The platform has already seen over $500 million in total volume – suggesting users are finding the platform useful and crypto-native traders are building activity.

Limitless Exchange Cons

- We were unable to locate any public, quality audit for the contracts that back Limitless. That means there is risk in case there are any vulnerabilities.

- This platform is relatively new, which means the long-term stability (liquidity depth, user base, security track record) is unproven yet – hence making the per-exchange risk higher than well-established ones.

- Some features like ultra short markets, custom markets, reward mechanics, etc., are still at roadmap or promise level, not all live or tested yet – so don’t just take your vendors’ word for it, anything and everything will be available right away.

- The ups and downs of prediction markets (and tokens like LMTS) mean that their gains and rewards may vary a lot, and there may potentially be more downside as we go forward if volume or user activity falls.

Is Limitless Exchange Worth Using in 2026?

It is quick to put Limitless in the same bracket as crypto casinos. After all, both allow you to put up crypto for a chance of making a profit. However, in reality the difference between a prediction market and a casino is more than just skin deep.

Limitless and other prediction markets operate a peer-to-peer trading model. This means users essentially bet against one another on future outcomes (for example, price moves or event results). The exchange doesn’t set the odds or act as the house, it only enables trades and takes tiny fees. In contrast, casinos enjoy a “house advantage”. The house sets the odds, bears the risk, and usually profits from users’ losses over time.

Due to this structure, prediction markets determine the outcome prices of their outcomes based on the collective opinion and market supply and demand and not through randomness or “luck.” This makes them more like financial trading or investing where skill, analysis and strategy can influence the outcome, whereas casinos mostly rely on RNGs and luck.

For users, this means that using Limitless isn’t “casino gambling”: you’re doing something that most call forecasting or speculative trading. In a good prediction market, you know what you are risking, what you could get, and everything is settled based on an actual outcome, not a “house shuffle.”.

That said, prediction trading always comes with a risk just like any speculation market. Issues like limited liquidity, low participation, or unusual events can affect outcomes. And unlike a casino, there’s no “house guarantee.” But there’s also possibility for smarter, data driven decisions for users who use it for trading, not gaming.